Disclaimer: This post contains affiliate links. I may recieve a commission if you purchase through links on this page.

Disclaimer: This post contains affiliate links. I may recieve a commission if you purchase through links on this page.

Since I’m now a graduate student *yikes* it’s about time I share my college experiences with the world. As an accounting student, it only seems fair that I share my financial and budget advice with you as well. Now, I get pretty serious when I talk about budgets and finances, even if I still have a little bit to learn about them myself.

If you’re reading this as a freshman in college thinking that it doesn’t apply to you, keep reading! These investments do become more important after you graduation, but you can always get started early! There will be a few things on this list that you can just go out there and buy, but others will be a little bit different. Still, whether it’s money or time, it’s all an ‘investment.’

A Good Fitting Suit + A Pair of Sensible Shoes

I got my first suit in Freshman year… of high school. I didn’t replace it until very recently. In fact, I just got a new one before my senior year of college because I got an internship and I was professional clothes shopping anyway. I didn’t replace my suit for almost six years and it showed. My jacket didn’t fit me right because, well, some things grew while I was in college. (I also put on weight, but that’s a different story.)

I ended up not wearing my suit to interviews because it fit so poorly. If you are going into the working world, especially into the corporate world, get a good fitting suit. Personally, I would recommend getting it while you’re still in college, but I understand that’s not a possibility or necessity for everyone (yes for business majors though).

I got my suit at Ann Taylor and I love how it fits. My jacket is actually a petite size and it fits me pretty well. I think it’s because I have an odd torso or something because I am not a petite. I am wearing a Vince Camuto blouse underneath, which is sleeveless because I personally don’t like how sleeves feel under jackets. It also helps in the Tucson heat. I own that shirt in four colors now.

My shoes are also from Ann Taylor and are quite comfortable once they’re broken in. In fact, I choose these pumps over my flats sometimes – they’re that comfy. A good fitting pair of pumps will take you a long way in the working world, so get a nice comfortable pair from the start.

Shop my Suit:

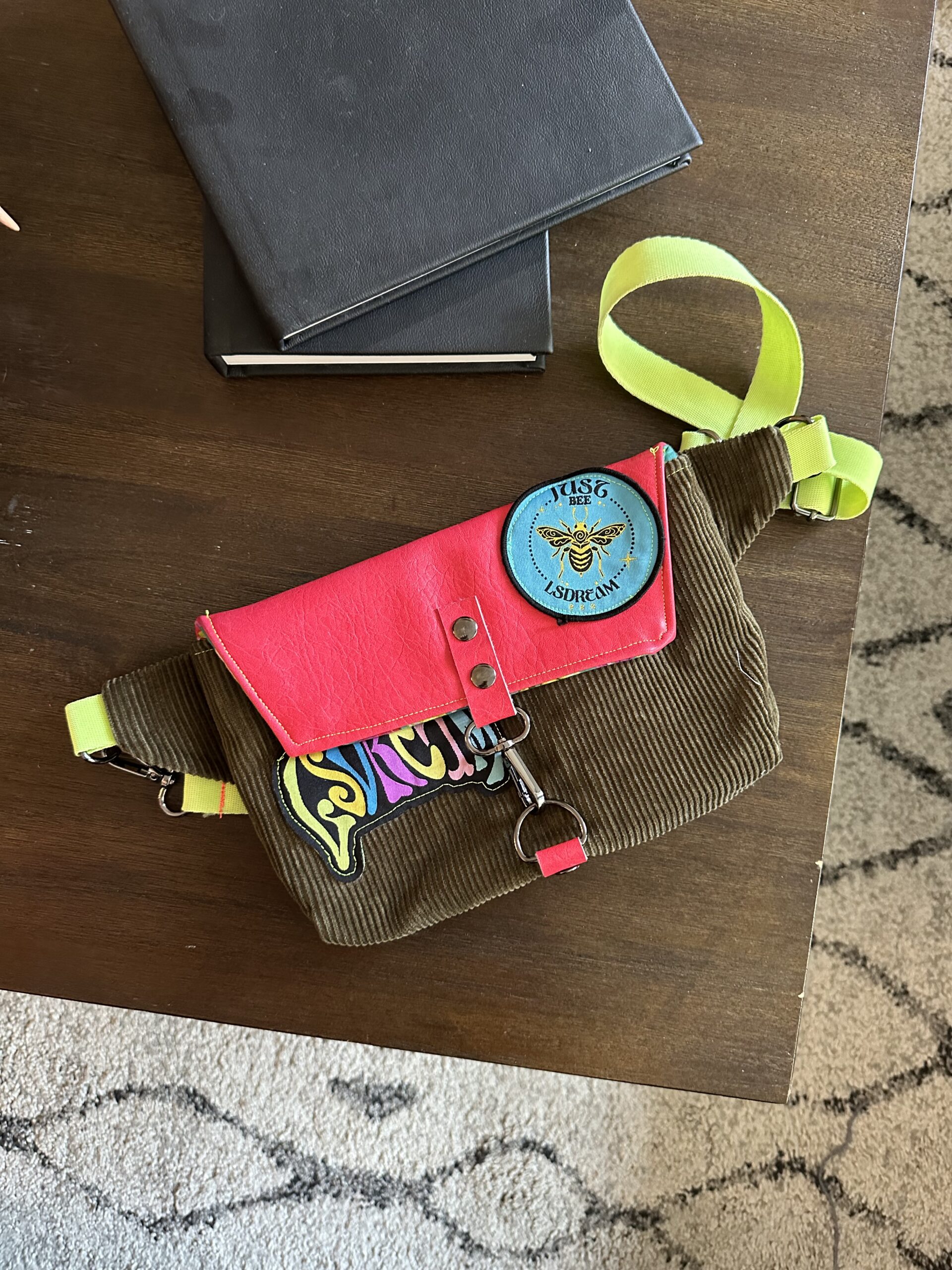

A Quality Do-It-All Handbag

A nice handbag is an essential in the working world, no matter what field you’re in. I prefer structured shapes like the bowler bag I’m using in the photos below. This bag is perfect when I’m not toting my computer around with me.

When I am carrying around a computer, I prefer a backpack or tote bag since those are usually large enough to carry a sturdy work laptop in. I talked about this bag I’m wearing in a post a week ago and how cool this technology is for the modern woman. To recap: it has a one-touch SOS device and a portable phone charger – perfect for a soon to be city girl on the go like myself.

Since I understand that some of you may want a bag that can also carry a laptop, I’ve also linked some of my favorite handbags, perfect for carrying that computer around.

Related post: Aubry Lane Bag Review

Aubry Lane Work Bag Picks:

Safira Bowler Bag

Zoelle Tote

Danton Tote

Mirele Laptop Bag

Aysel Backpack

A Retirement Plan

Ok, maybe you’re not thinking about retirement yet, but you should be. If you start planning now, you’ll be way better off in the future.

In my opinion (and my tax professor’s too), you should try to start a retirement plan by the time you are 25. There’s something to be said about compounding interest, folks. Take it from an accounting major, it’s a big deal. If you’re employer offers retirement contribution matching and a 401k, take it. It’s basically free money.

If you don’t know what I’m talking about: a lot of employers will match your contribution to your retirement plan up to a certain percentage of your monthly income. I think I will get something like 50% of the first 6% of my income or something along those lines. Make sure you take advantage of that from the beginning of your employment and watch those savings grow.

Now, if your employer doesn’t offer matching, don’t worry! You can still use your employer’s 401k plan or open up your own IRA. I currently have a Roth IRA – which means I pay taxes now rather than later – because my current tax bracket is so low. If you’re working full time, a traditional IRA may be your best bet, but it’s hard to say without additional info. Choose what’s best for you after you research your options, but above all – just start saving for retirement early!

An Investment Account

Ok, so you just opened a retirement account, that’s the same thing, right? Well, technically yes, but there are a few very important differences. First, your retirement savings are not liquid. This is very important. Once you put money into retirement, forget it exists. I mean it, taking money out of your retirement is a bad idea. That’s why it’s important to have another investment account that has more liquidity – it can turn into cash easily. This way, in case you need to pull money out to make a big purchase such as a house or a car, the money is available.

For my investments, I currently use Wealthfront and Acorns! They’re two nearly effortless ways to invest and I’ll tell you all about how easy they are to use below.

Wealthfront:

Wealthfront was the first *serious* investment account I opened. It’s essentially an automated investment machine that does all the heavy lifting for you 24/7! They will create a diversified portfolio for you based on your personal preferences. I love how little work is involved for me. They also work hard to keep your fees and taxes low, which is a huge plus.

If you invest in Wealthfront using my link, you will get an additional $5,000 in assets managed for free!

Get $5000 managed for free: Invest with Wealthfront HERE

Acorns:

My very first dip in the pool of investments was through Acorns. I have a recurring investment of $10/week set up, but this app also connects to your bank and invests your “spare change.” So, if you make a $4.57 purchase, the additional $.043 will be invested into this accounts. It “rounds-up” all of your purchases on your card, puts the money on hold until it reaches a threshold of $5, and then withdraws it from your bank and invests it for you. I end up investing about $75 per month without even thinking about it! Plus, the change is so small, you’ll hardly miss the difference!

If you’re a student, they manage your investments for free. The fees are also pretty low, so if you’re not a student, you could still afford to invest small change with this app. It’s perfect if you don’t have a big initial investment to make and would rather see how much you’ve saved over time. If you want a free $5 (it’s not much, but it’s free money) to start investing, just invest using my link below!

Get a free $5 for investing: Invest with Acorns HERE

A Long Term Savings Goal

Ok, well maybe this isn’t really an investment – but you’ll have to invest time and some money in order to reach a long term savings goal. Maybe you want to buy your first house or start saving for a wedding or you’re thinking about a big move – all of those things require saving. It’s a commitment.

Set up a longer term savings goal to work toward. If you have something in mind – it will be easier to save. A car is a big purchase, a house is a big purchase… Financing can go a long way, but it’s good to have some cash saved up for that purchase too.

For me, I’ll be thinking about potentially relocating outside of the country for a few years and I’ll need a bit saved up in case I come up empty on the job front for a few months. Plus, there are relocation expenses, flights, and even more to think about when considering a big move.

Related Post: Sh*t to Think About When You Move Abroad

A Budget

Ok, so you’ve graduated and now you have a full-time job. What does this mean? You need to start budgeting because real life is about to hit you real hard. No more allowances from mom + dad, or grocery money, or help with the rent or utilities bill. (No offense to those of you who worked through college and didn’t get financial help from your parents, I’m just making a generalization. Also, hats off to you for your hard work.) You own all your own ish now.

The general rule for budgeting is the 50/20/30 rule. It’s a pretty solid way to start a general budget.

50% of your income goes into essentials, or nonvariable expenses, such as housing, food, transportation, and utilities. The percentage lets you adjust, while still maintaining a sound, balanced budget. Some people may have a lower or higher cost of living but make more or less money accordingly. Some people may also enjoy low rent and high transportation costs and vice versa.

20% of your income goes into your savings, which is pretty self-explanatory. I would make a minimum contribution to your retirement account (max out the matching from your employer if you can) and then split the rest between a “rainy day” fund, a long-term savings goal (such as a down payment on a house), and an investment account. If you have to pick only two the the three things, that’s ok too, just do your best to put some of that income away for later.

The remaining 30% goes toward flexible spending. This is clothing, traveling, your cell phone plane, morning coffee – if it’s not a necessity, it goes in this category. The bad news is it’s really easy to spend too much in this category, but the good news is that it’s also the easiest place to make cuts! I use my Mint app to keep track of how much I’m spending. Clothing and Travel seem to be my weaknesses, but that would make sense given my interests on my blog. I’m trying to cut back on clothing, which is getting easier now that I have a work capsule wardrobe for work and I don’t wear as many cute, casual outfits as I used to.

Mint:

I’ve been using Mint as of late to track my spending. If I could tell you one thing, I started doing this too late. I wish I had started tracking my spending sooner, rather than just getting a minor heart attack when my credit card bill came at the end of every month. Mint connects to your cards, you can also link your investment accounts, to track how much your spending and making so you can create appropriate budgets for yourself. It’s a good tool and a great habit to start early.

In fact, all of these are good things to invest in early! If you liked this post, feel free to share it with other people like you or another college student who’s looking for her next financial move. Good luck investing!

Hi there!

I just wanted to say that I love this post and found it super helpful! I know I’m a little young for it because I won’t be a college freshman until fall but I am definitely one to plan ahead and this was incredibly easy to follow and useful. I will definitely be following your tips and thank you for your insights and advice!

Hi Emma! I am so glad you stumbled upon this post! Even though I targeted college grads – don’t forget that it’s never too early to start investing! Mint offers small investments with no fees for students!

You rock girl! I have to agree on the handbag. Once I started a “real job” I made it a priority to upgrade myself from a backpack to a stylish tote bag to carry all my necessities to work. I also really appreciate all your financial tips! Will be saving this post 🙂

http://www.insearchofsheila.com

Thanks so much girl! I have 2-3 bags I rotate because I’m such a diva they need to match my outfit ha! Let me know if you ever have any more financial questions!